Welcome to the Third View Perspectives Newsletter—your monthly source for financial intelligence and trusted advice to help you make more informed decisions on behalf of you, your family, and your legacy.

Forwarded this newsletter? Subscribe here to receive future editions.

EDITORIAL

The Golden Age for Advice: Our Commitment to Serving Generational Wealth

Written by Frank McKiernan, adapted from an article originally published in Forbes

Over the next two decades, the role of the wealth advisor will undergo a significant transformation, and I’m not talking about artificial intelligence.

I’m talking about how we advise clients and how that advice is delivered.

According to Cerulli Associates, an estimated $124 trillion is projected to transfer hands by 2048, largely from Baby Boomers and the Silent Generation to Gen X, Millennials, and Gen Z.

These numbers are significant, but the story goes far beyond the dollars. This moment marks a generational shift in values, expectations, and priorities that will challenge advisors to prove they are the best stewards of a family’s financial well-being.

Over the past decade, I’ve had the privilege of working with individuals and families across the country. What I’ve observed is an increasing demand for advice that is independent of where their assets are custodied or how they are invested.

They want advice that is comprehensive, strategic, and deeply personal.

As advisors, we’re constantly asking ourselves: How are we creating value beyond managing a portfolio of stocks and bonds?

That’s why we’ve built a multi-family office model—one that integrates wealth management, trust and estate planning, tax strategy, and family office consulting into one client experience.

The next generation of wealth holders is asking for something different. They want more than traditional wealth management. They want a trusted partner. Someone who sees the full picture and understands their values, their family, their business, and their ambitions.

They want advice that is not fragmented. They want integration of their investments, taxes, trust and estate strategy and philanthropic initiatives.

Our view is that next-generation wealth advisors won’t be defined by who is at the largest firm or who delivers the highest returns in a given quarter or year.

It will be defined by who listens well, rolls up their sleeves, and creates the most value. That’s the standard we hold ourselves to at Third View—and it’s the foundation of how we will continue to serve you, our clients, and your families for generations to come.

FINANCIAL INTELLIGENCE

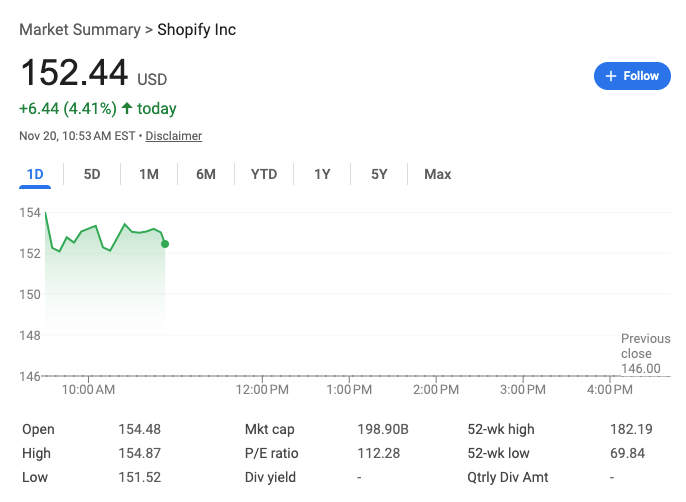

Disruptive Companies On the Rise: Shopify

An internal memo from Shopify CEO Tobias Lütke was leaked earlier this summer, and it caught our attention. One part of the memo read:

“Before asking for more headcount and resources, teams must demonstrate why they cannot get what they want done using AI. What would this area look like if autonomous AI agents were already part of the team? This question can lead to really fun discussions and projects.”

Safe to say, it caught the attention of many people online and sparked heated conversation on whether or not Shopify’s approach to AI was the right one. Whether it is or isn’t, it’s an example of Shopify’s disruptive approach to their business, and likely a contributor to their significant rise in the last couple of years.

Based on an article from The Stock Market Nerd, here’s a deeper dive into the Shopify story, and what’s contributed to their success:

In 2006, a frustrated programmer named Tobias Lütke set out to build his own snowboard store online. That simple project grew into Shopify, a $60 billion e-commerce platform now powering more than four million merchants worldwide.

Shopify’s business model has two key engines. The first, Subscription Solutions, charges merchants monthly fees for access to its software—everything needed to design an online store, manage products, track inventory, and analyze sales. The second, Merchant Solutions, earns a small percentage of every transaction that flows through Shopify’s systems. As merchants grow, Shopify’s revenue scales with them.

The company’s core advantage is integration. Shopify provides a single platform that connects all aspects of commerce—online storefronts, in-person sales, marketing, fulfillment, and payments—into one dashboard. Its checkout product, Shop Pay, is now one of the fastest and highest-converting payment tools on the web. Shopify has also expanded into point-of-sale hardware for physical stores and built partnerships with Meta, Google, and TikTok to help merchants sell directly through social platforms.

Shopify’s products aren’t just for small online retailers and Mom and Pop shops. For larger brands, Shopify offers Shopify Plus and Commerce Components, enterprise-grade versions that let companies like Heinz, Unilever, and Mattel integrate Shopify tools into their existing operations.

For investors, Shopify represents an enduring trend: the democratization of digital commerce. It’s a platform designed not only to lower barriers for entrepreneurs, but also to capture the rising tide of direct-to-consumer retail globally.

While this isn’t meant to be investment advice, it’s a company we’ll be keeping an eye on, and you should too.

🎧 One of our favorite podcasts, Acquired, hosted a recent conversation with Shopify CEO Tobias Lütke. Check it out here.

ASK THE ADVISORS

How do I make sure my heirs manage their inheritance wisely?

A: It’s a great question, and there’s no simple answer. We believe the best way to prepare children and grandchildren for inherited wealth is through a combination of education, communication, and thoughtful structure.

As we’ve written about before, we encourage families to start conversations early about values, stewardship, and the purpose of wealth. The most accessible way to do this is to start involving the next generation in philanthropy efforts, family money meetings, or investment discussions.

There’s also a structural element to the equation. We often work with clients to design trusts that balance access with responsibility, giving younger heirs room to learn and grow while maintaining financial discipline.

One way to accomplish this is through thoughtful trust design that aligns access with maturity. Many families choose to incorporate provisions such as staggered distributions, incentive-based milestones, or trustee-guided access to ensure heirs develop the skills and judgment needed to manage wealth responsibly.

These structures provide a framework for learning, allowing beneficiaries to make decisions, experience consequences in a controlled way, and gradually take on more responsibility as their financial capabilities grow.

Have a question you’d like us to answer in a future newsletter? Simply reply to this email to submit it to us.

CONTENT CORNER

What We’re Paying Attention To

📖 Book Recommendation

Born of this land : my life story by Chung Ju-Yung the journey of leaving home penniless and creating Hyundai Group only with his two mottos, sincerity and credit. Great read. Find it here.

🎧 Podcast Recommendation

The Acquired episode on Rolex is a great one. Their intentional scarcity strategy to build mystique and demand is fascinating. Listen here.

🎧 Podcast Recommendation

This conversation between Andrew Huberman and Marc Andreessen on Huberman Lab reframes how we think about innovation, risk, and human progress. Provides a great case of optimism for the future. Listen here.

ICYMI

Our Latest News, Press, and More

Third View Co-Founder, Jerry Sneed, recently was a panelist at the ALIAVIA Ventures LP & Founder Annual Summit, an exclusive, invite-only event in Laguna Beach, California.

This summit was all about deepening community and fostering meaningful relationships among those who are passionate about building more billion-dollar businesses founded and led by women. See the post here.

More Press

That’s all for this month. If you enjoyed the newsletter, the greatest compliment would be to forward it to someone you think would find it valuable. We’ll be back with more next month.

- Frank, Jerry, and Zoltan

Forwarded this message?

Sign up here to receive future newsletter editions in your inbox.

Any media logos and/or trademarks are the property of their respective owners and no endorsement by those owners of the advisor or firm is stated or implied.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Information obtained from third-party sources is believed to be reliable though its accuracy is not guaranteed, and Third View Private Wealth makes no representation or warranty as to the accuracy or completeness of the information, which should not be used as the basis of any investment decision. Information contained on third party websites that Third View Private Wealth may link to is not reviewed in their entirety for accuracy and Third View Private Wealth assumes no liability for the information contained on these websites. Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of writing and are subject to change without notice. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Third View Private Wealth. For more information about Third View Private Wealth, including our Form ADV brochures, please visit https://adviserinfo.sec.gov or contact us at (203) 408-0098.