Welcome to the Third View Perspectives Newsletter—your monthly source for financial intelligence and trusted advice to help you make more informed decisions on behalf of you, your family, and your legacy.

Forwarded this newsletter? Subscribe here to receive future editions.

EDITORIAL

The Glue Is What Sustains the Legacy: Rethinking a Family Legacy Around Emotional Value

Article written by Jerry Sneed, Co-Founder & Managing Partner

What’s the point of a $10, $20, $50, or even $100 million legacy if the family doesn’t enjoy or appreciate one another for who they are?

I work with families across the country, always with an educational approach. My goal is to provide value in all aspects of their lives. Naturally, that leads me to integrate into families for everything finance-related, and often beyond.

Many of my clients are first-generation wealth holders. They may have inherited a business that generates significant income, but their parents or grandparents often had minimal liquid wealth. As a result, they have never been taught how to manage a sudden influx of money or the emotional weight that comes with it.

Imagine someone who inherits an aircraft parts business or a large real estate portfolio and later sells it to a strategic buyer or private equity firm. Despite newfound wealth, they often struggle to spend. Why? Because they were raised with values shaped by scarcity, by watching parents stretch every dollar. They know they cannot take it with them, but they also cannot bring themselves to enjoy it.

This inability to spend wisely creates a ripple effect. If they cannot conceptualize spending on themselves, how can they confidently pass wealth to their children? How do they decide who deserves it? How do they make it fair when each child has a different path?

FINANCIAL INTELLIGENCE

Frank McKiernan joins NYSE TV to talk earnings, bull market, and jobs report

5 things you should know:

1) Our view is a new bull market for US equities began early April, fueled by policy tailwinds and likely Fed easing.

2) Trade Deals = upside: we expect progress with China, removing a major headwind for equities.

3) Valuations are rich but workable (~22x forward EPS) if earnings stay strong and rates drift lower.

4) It’s not just Big Tech: earnings breadth is expanding across small/mid caps; AI adoption is accelerating.

5) 4Q focal point: watch incoming US economic data to govern the speed of Fed easing.

Why It Matters

We’re watching these developments closely to ensure portfolios capture the benefits of market strength while remaining mindful of shifts that could impact different asset classes. Understanding how policy, earnings trends, and global trade intersect helps put day-to-day market moves in perspective.

ASK THE ADVISORS

When should I start talking to my kids or grandkids about money?

A: Earlier than most people think. Our advice is to keep it simple at first. For younger children, focus on values, not numbers. That might mean talking about where money comes from, the importance of saving for something special, or how your family chooses causes to support.

As they grow, you can introduce bigger ideas: how investments work, why you budget, or how you make major financial decisions. With adult children, life events like marriage, starting a business, or buying a home are natural opportunities to have deeper conversations about your plans and their future role.

A few good “first conversations” might include:

Earning: What you did to make your first dollar.

Saving: Setting a goal and working toward it.

Giving: Choosing a cause and supporting it together.

Spending: Deciding between “wants” and “needs.”

The key is to make these discussions gradual and ongoing, so by the time significant assets are involved, your children or grandchildren are prepared, confident, and aligned with your values.

Have a question you’d like us to answer in a future newsletter? Simply reply to this email to submit it to us.

CONTENT CORNER

What We’re Paying Attention To

This episode with Dr. Arthur Brooks on the Jordan Peterson Podcast is a great one because it unpacks what truly drives lasting fulfillment—and challenges the idea that success alone guarantees happiness. Listen here.

The Ride of a Lifetime by Bob Iger is a front-row look at leadership under pressure, bold decision-making, and building lasting culture. It’s a classic business book with so many more lessons at play. Find it here.

One book I recommend anyone read is ‘How to Invest’ by David Rubenstein, Co-founder of The Carlyle Group. The book is filled with tons of wisdom and great interviews with some of the world’s most successful investors. My favorite chapters are the interviews with Seth Klarman, Jon Gray, Adebayo Ogunlesi, and Marc Andreessen. Find it here.

ICYMI

Our Latest News, Press & More

Congratulations to Third View Co-Founders Jerry Sneed and Frank McKiernan for being named Forbes Best-In-State Top Next-Gen Wealth Advisors in 2025.

More Press

THIRD VIEW UPDATES

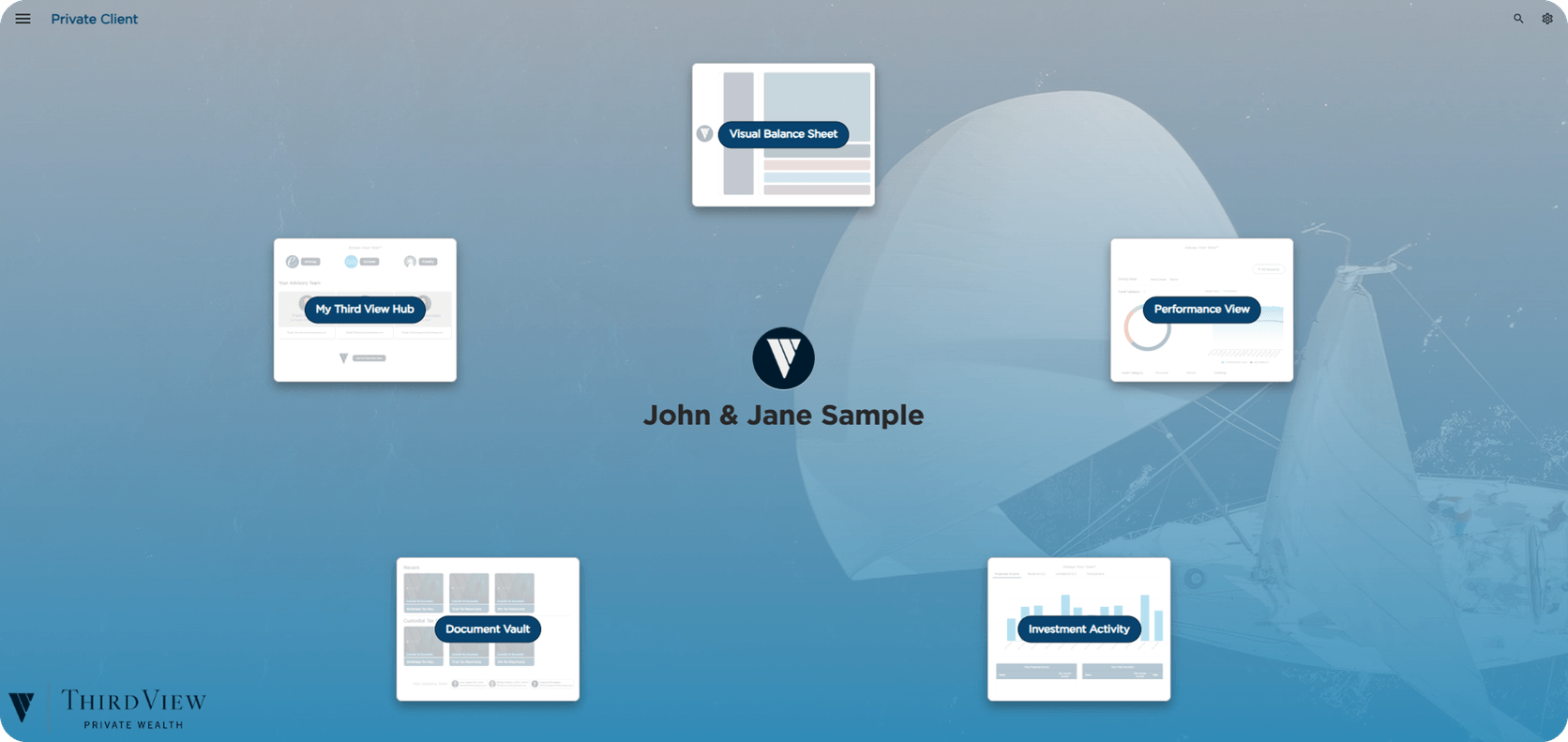

Introducing The New Third View Private Client Portal

This month, we introduced our new Third View Private Client Portal. It's an experience designed around you, to make your financial life clearer, simpler, and more personal than ever.

Through your client portal, you'll be able to see multiple aspects of your financial picture, including your balance sheet, investments, performance, key documents, meeting summaries, and more, together in one secure place.

Our goal is to equip Third View clients with the most advanced tools and technology on the market to make it easy to see and understand your complete financial picture. We look forward to incorporating your feedback and suggestions as we continue to build this platform.

If you have any questions about the new Private Client Portal or are having any difficulty accessing it, reply to this email and we’ll follow up.

That’s all for this month. If you enjoyed the newsletter, the greatest compliment would be to forward it to someone you think would find it valuable. We’ll be back with more next month.

- Frank, Jerry, and Zoltan

Forwarded this message?

Sign up here to receive future newsletter editions in your inbox.

Any media logos and/or trademarks are the property of their respective owners and no endorsement by those owners of the advisor or firm is stated or implied.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Information obtained from third-party sources is believed to be reliable though its accuracy is not guaranteed, and Third View Private Wealth makes no representation or warranty as to the accuracy or completeness of the information, which should not be used as the basis of any investment decision. Information contained on third party websites that Third View Private Wealth may link to is not reviewed in their entirety for accuracy and Third View Private Wealth assumes no liability for the information contained on these websites. Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of writing and are subject to change without notice. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Third View Private Wealth. For more information about Third View Private Wealth, including our Form ADV brochures, please visit https://adviserinfo.sec.gov or contact us at (203) 408-0098.