Hey, it’s Frank, Jerry, and Zoltan from Third View Private Wealth, and welcome to the Third View Next Gen Newsletter. This newsletter is designed to simplify personal finance, investing, and wealth building for next-generation wealth holders just starting their financial journey. Hope you enjoy this month’s edition and learn something new.

Forwarded this newsletter? Subscribe here to receive future editions.

IMAGINE THAT

The historic rise of LLMs.

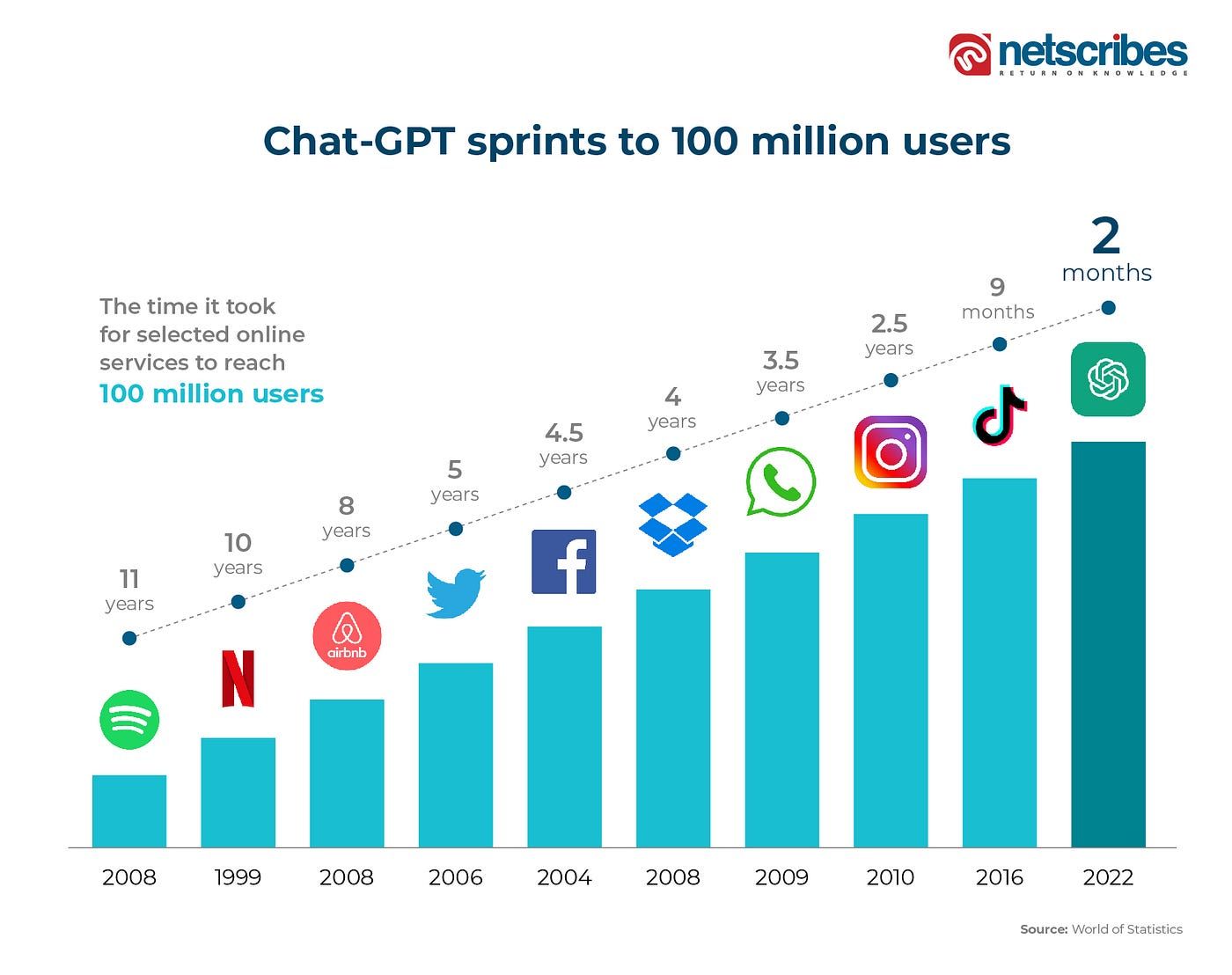

We’re witnessing something remarkable with large language models (LLMs) like ChatGPT. It took ChatGPT 2 months to reach 100 million users. That’s over 4x faster than the next fastest platform, TikTok, back in 2016.

So…what exactly is an LLM?

Imagine an AI that’s read the entire internet, every book it could find, and probably your old Tumblr posts too. That’s basically an LLM.

It doesn’t think like a person, it just got really good at noticing how words fit together and identifying trends. After reading trillions of sentences (that’s where the “large” part of the name comes in), it can now predict what word (or idea) should come next. That one trick lets it do all kinds of things like write essays, summarize articles, explain rocket science, or just chat about your favorite TV show.

Unlike the old-school computer programs that follow strict rules, LLMs make educated guesses—kind of like the friend who can finish your sentences. That mechanism is what powers tools like ChatGPT, Claude, and Gemini.

In short, an LLM is the ultimate language nerd. It doesn’t sleep, doesn’t get bored, and can talk about almost anything. Just know that they aren’t right 100% of the time… so be intentional about how you use them for school work or to help you on the job.

FINANCIAL SMARTS

The Power of Compounding: How Small Decisions Today Multiply Over Time

You’ve probably learned about the power of compound interest in a finance class. Invest early, let time do the work, and watch your money grow exponentially. Just to prove the point, here’s a visual to showcase the power of compounding, because humans often underestimate what compound interest actually looks like.

But compounding isn’t just a financial concept. It’s one of the most powerful forces in life. The earlier you start making intentional choices, the greater the payoff becomes in your career, relationships, health, and beyond.

In our work with entrepreneurs, executives, and high performers, we’ve seen one pattern repeat again and again: the people who thrive long term invest early and consistently in a few key areas of life.

Finances: Even small savings or investments made early can grow into something meaningful. Building the habit of saving and investing consistently while you’re young matters far more than the amount you start with.

Education and Skills: What you learn in your twenties sets the foundation for everything that follows. Read, explore, and develop skills that make you adaptable and curious—even if it means spending some money on them. Those early efforts open doors years down the road. Check out our recommended books and podcasts below for some great learning opportunities.

Network: Relationships are one of the most valuable assets you can build. Stay connected, help others, and invest time in people you respect. Over time, we’ve seen those relationships compound into all kinds of personal and professional opportunities.

Physical Health: You only get one body. Consistent exercise, sleep, and nutrition habits create energy and resilience that fuel every part of life. The earlier you start building health-promoting habits, the more you benefit later on.

The principle is simple but powerful: start early, stay consistent, and give your efforts time to compound. Whether it’s your finances, your career, or your health, time and patience are the ultimate multipliers if you let them work for you.

ASK THE ADVISORS

“What exactly is inflation? What causes it and how does it impact us?”

Inflation is the gradual rise in prices over time, which means your money slowly loses buying power. You’ve probably seen those posts about a McDonald’s cheeseburger costing 25 cents in the 1960s.

Were things really that much cheaper back then? Not exactly, because the price of everything has gone up. For reference, a new car in the 1960s cost around $2,600. Good luck finding anything that runs for that price today…

Inflation happens for a few reasons, like higher production costs, strong consumer demand, or an increase in the money supply.

The key takeaway here is to know that inflation isn’t going away. It’s not something you can control, but it is something you can plan for.

With an average inflation rate of about 3% per year, investing early is how you stay ahead. The sooner you put your money to work, the more time it has to grow faster than prices rise.

Have a question you’d like us to answer in a future newsletter? Simply reply to this email to submit it to us.

CONTENT CORNER

Reading and Listening Recs

📚 Book Recommendation

How to Make a Few Billion Dollars by Brad Jacobs is my all-time favorite book about how to build and run a business. Find it here.

🎧 Podcast Recommendation

Naval Ravikant’s interview on the Modern Wisdom podcast with Chris Williamson was awesome. He talked about 4 harsh truths about the game of life. Listen here.

📚 Book Recommendation

While society seems to glamorize “hustle culture”, Do Hard Things by Steve Magness is a great reminder of what toughness really looks like and how to develop it. Find it here.

ICYMI

Third View In The News

Third View Co-Founder, Jerry Sneed, recently was a panelist at the ALIAVIA Ventures LP & Founder Annual Summit, an exclusive, invite-only event in Laguna Beach, California.

This summit was all about deepening community and fostering meaningful relationships among those who are passionate about building more billion-dollar businesses founded and led by women. See the post here.

More Press

That’s all for this month. If you enjoyed the newsletter, the greatest compliment would be to forward it to someone you think would like it too.

- Frank, Jerry, and Zoltan

Forwarded this message?

Sign up here to receive future Third View Next Gen Newsletter editions in your inbox.

Any media logos and/or trademarks are the property of their respective owners and no endorsement by those owners of the advisor or firm is stated or implied.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Information obtained from third-party sources is believed to be reliable though its accuracy is not guaranteed, and Third View Private Wealth makes no representation or warranty as to the accuracy or completeness of the information, which should not be used as the basis of any investment decision. Information contained on third party websites that Third View Private Wealth may link to is not reviewed in their entirety for accuracy and Third View Private Wealth assumes no liability for the information contained on these websites. Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of writing and are subject to change without notice. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Third View Private Wealth. For more information about Third View Private Wealth, including our Form ADV brochures, please visit https://adviserinfo.sec.gov or contact us at (203) 408-0098.