Hey, it’s Frank, Jerry, and Zoltan from Third View Private Wealth, and welcome to the Third View Next Gen Newsletter. This newsletter is designed to simplify personal finance, investing, and wealth building for next-generation wealth holders just starting their financial journey. Hope you enjoy this month’s edition and learn something new.

Forwarded this newsletter? Subscribe here to receive future editions.

IMAGINE THAT

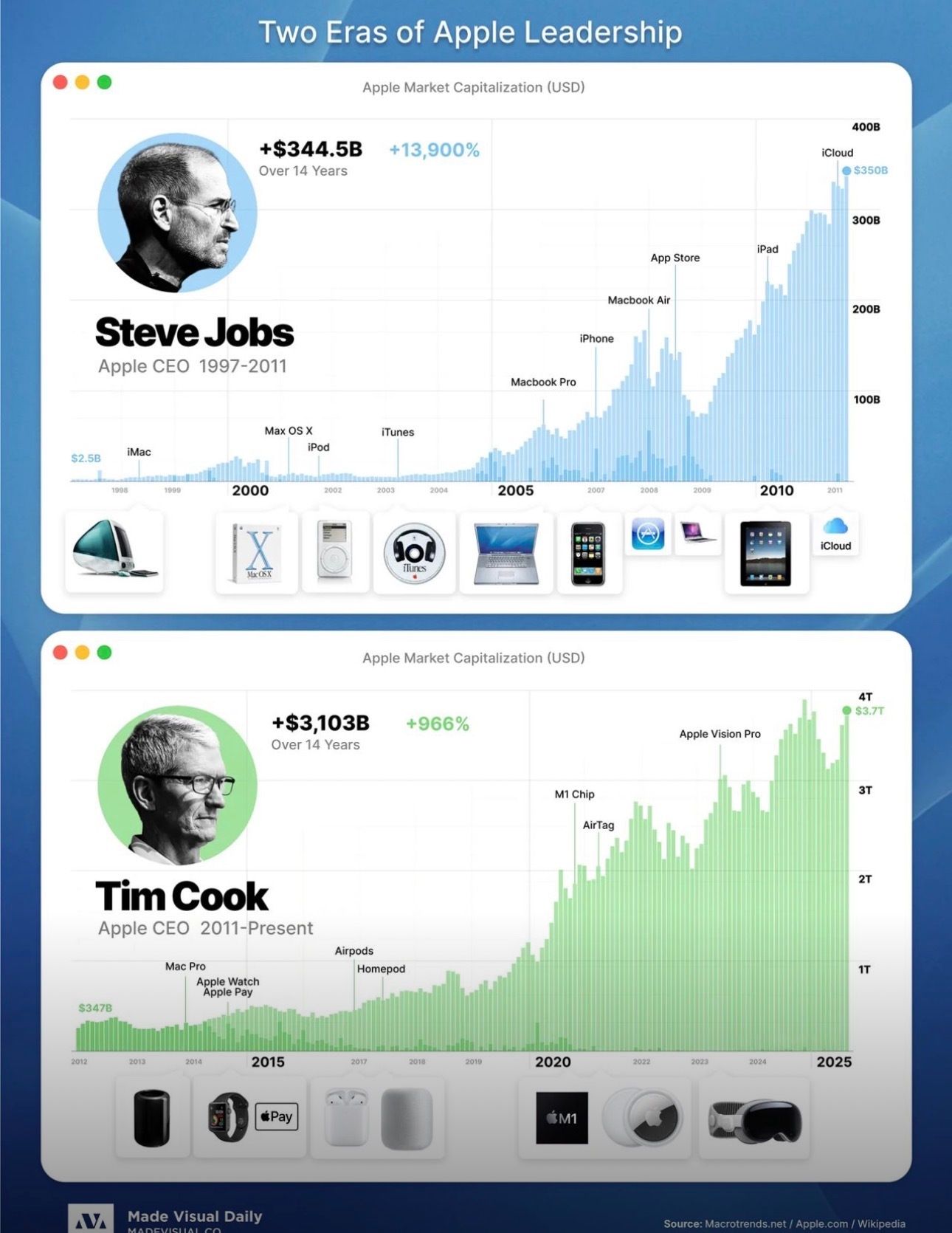

The Two Eras of Apple Leadership

We thought this was an interesting visual of Apple’s growth under Steve Jobs compared to their growth under now CEO, Tim Cook. There have been many milestones and significant growth under both CEOs… which CEO do you think has been better for Apple?

FINANCIAL SMARTS

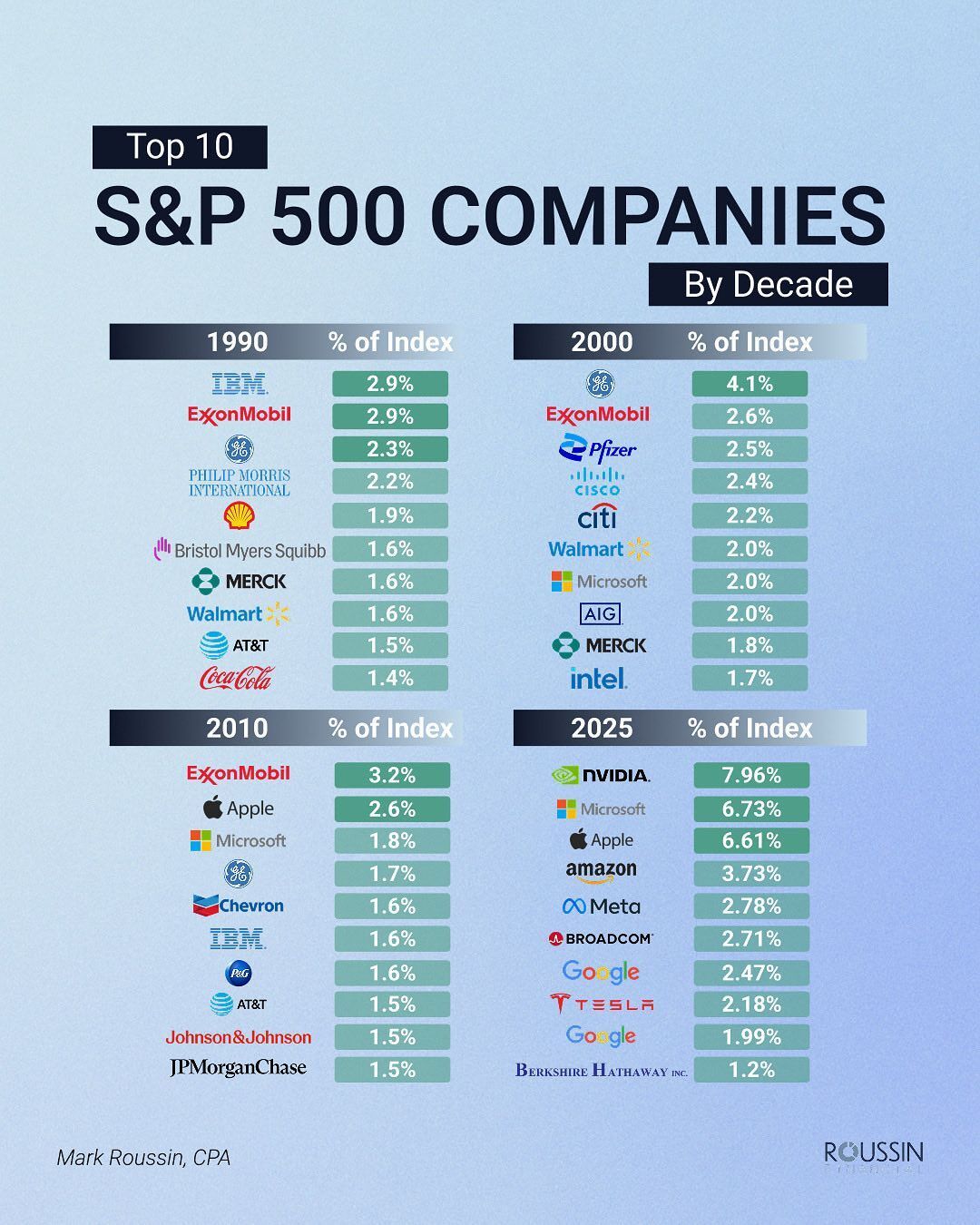

Then and Now: Comparing the Top Companies in the S&P 500

Check out this graphic that compares the top 10 companies based on their percentage of the S&P 500 index over the last few decades.

Two things to take away:

1) Only two companies (Microsoft & Apple) that appear in the top 10 in 2025 also appeared on the list 15 years ago. In the technology age, massive companies can start and scale incredibly quickly.

2) The percentage of the index taken up by today’s top companies is significantly larger than in recent decades. When a few giant companies dominate, market moves are more heavily weighted toward those companies and may not always be representative of the economy as a whole.

What does this mean for the young investor?

Be intentional about diversification.

When a few mega-cap companies dominate the S&P 500, the index can look diversified but behave like a concentrated tech portfolio. Build a mix of asset classes and geographies, and don’t assume an index fund automatically does that for you.

Secondly, avoid the temptation to pile into what’s hot. The companies dominating headlines today may not be the ones driving returns over the next 20 years.

We’ve seen periods of high concentration like this before, back in the 60s and 70s. It’s unlikely the current leaders will dominate forever. History suggests leadership tends to rotate, though it can take years.

A diversified, long-term approach to investing is still the best route.

ASK THE ADVISORS

“If people think the stock market might go down, shouldn’t we take our money out?”

You’ll hear us talk a lot about investing in the stock market as a long-term game (like in the last section of this newsletter).

Have a strategy. Consistently invest in the market. Leave it in the market.

Why is that? If people are talking about a potential downturn, shouldn’t we take money out of the stock market?

While it might seem like a smart idea, data says otherwise. When you try to time the market by selling stocks before a potential downturn (when stock prices decrease), it’s possible you’ll miss days when the market rebounds. It’s also probable you’ll miss the days with the largest stock market gains.

Missing those days has a massive impact on performance.

$1 invested in the S&P 500 in 1950 and left in the market would be worth $400 today. If you tried to time the market and ended up missing the 50 best days? It would be worth $28. And if you missed the best 100 days? It would be worth $5.

Investing is a long-term game. Those who stick to their strategy and ride the ups and downs are likely to be the winners over time.

Have a question you’d like us to answer in a future newsletter? Simply reply to this email to submit it to us.

CONTENT CORNER

Reading and Listening Recs

🎧 Podcast Recommendation

There’s so much to learn from the stories of successful business people. The story of Elon Musk’s early days of SpaceX is fascinating. Listen here.

📚 Book Recommendation

You’ve probably heard of Michael Dell, founder of Dell Technologies…his book outlines the balance between winning in business and doing the right thing. Really good one. Find it here.

📚 Book Recommendation

An overlooked ingredient to success is your ability to observe and manage your energy based on the people and things that fill or take from your bucket. How Full is Your Bucket breaks this down really well. Find it here.

ICYMI

Third View In The News

Earlier this year (prior to the official launch of Third View), Jerry Sneed was invited on the Futureproof Advisor Podcast. We’re sharing it again because, among other things, Jerry talks about the importance of having a “why” behind building wealth—a core concept we discuss with all clients at Third View. Listen to the podcast here or click the image below.

More Posts & Press

That’s all for this month. If you enjoyed the newsletter, the greatest compliment would be to forward it to someone you think would like it too.

- Frank, Jerry, and Zoltan

Forwarded this message?

Sign up here to receive future Third View Next Gen Newsletter editions in your inbox.

Any media logos and/or trademarks are the property of their respective owners and no endorsement by those owners of the advisor or firm is stated or implied.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Information obtained from third-party sources is believed to be reliable though its accuracy is not guaranteed, and Third View Private Wealth makes no representation or warranty as to the accuracy or completeness of the information, which should not be used as the basis of any investment decision. Information contained on third party websites that Third View Private Wealth may link to is not reviewed in their entirety for accuracy and Third View Private Wealth assumes no liability for the information contained on these websites. Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of writing and are subject to change without notice. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Third View Private Wealth. For more information about Third View Private Wealth, including our Form ADV brochures, please visit https://adviserinfo.sec.gov or contact us at (203) 408-0098.