Hey, it’s Frank, Jerry, and Zoltan from Third View Private Wealth, and welcome to the Third View Next Gen Newsletter. This newsletter is designed to simplify personal finance, investing, and wealth building for next-generation wealth holders just starting their financial journey. Hope you enjoy this month’s edition and learn something new.

Forwarded this newsletter? Subscribe here to receive future editions.

IMAGINE THAT

Investment portfolios of famous investors.

Ever wondered what some of the wealthiest people in the world invest their money in? Or just us? 😅 Well, check out the portfolios of some of the most successful investors and CEOs.

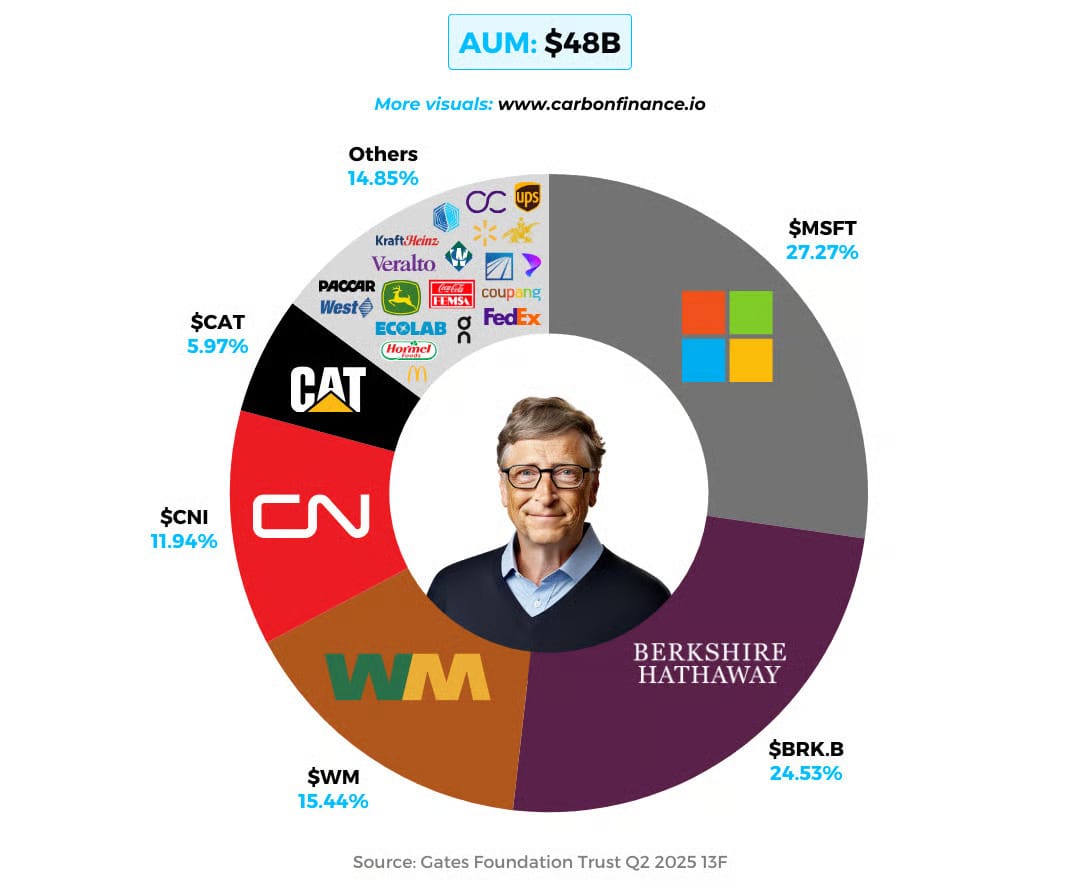

Bill Gates: co-founder of Microsoft.

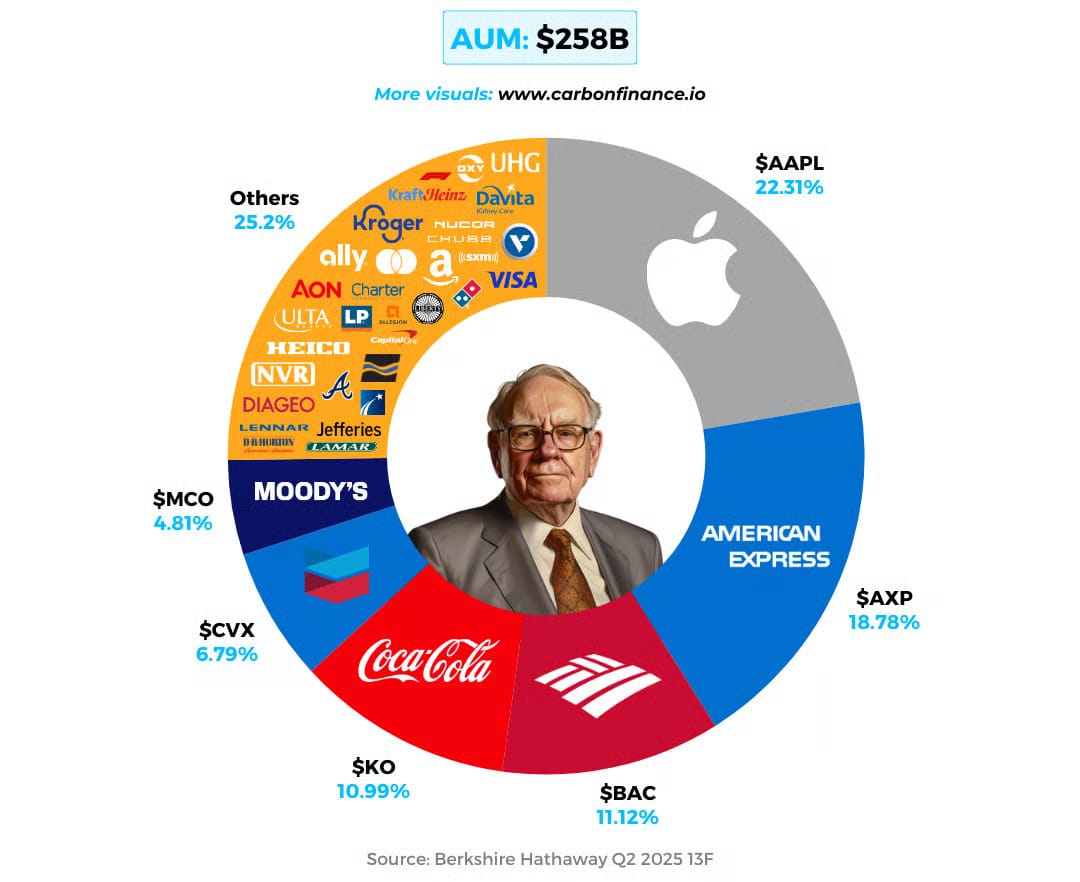

Warren Buffett: CEO, Berkshire Hathaway Inc.

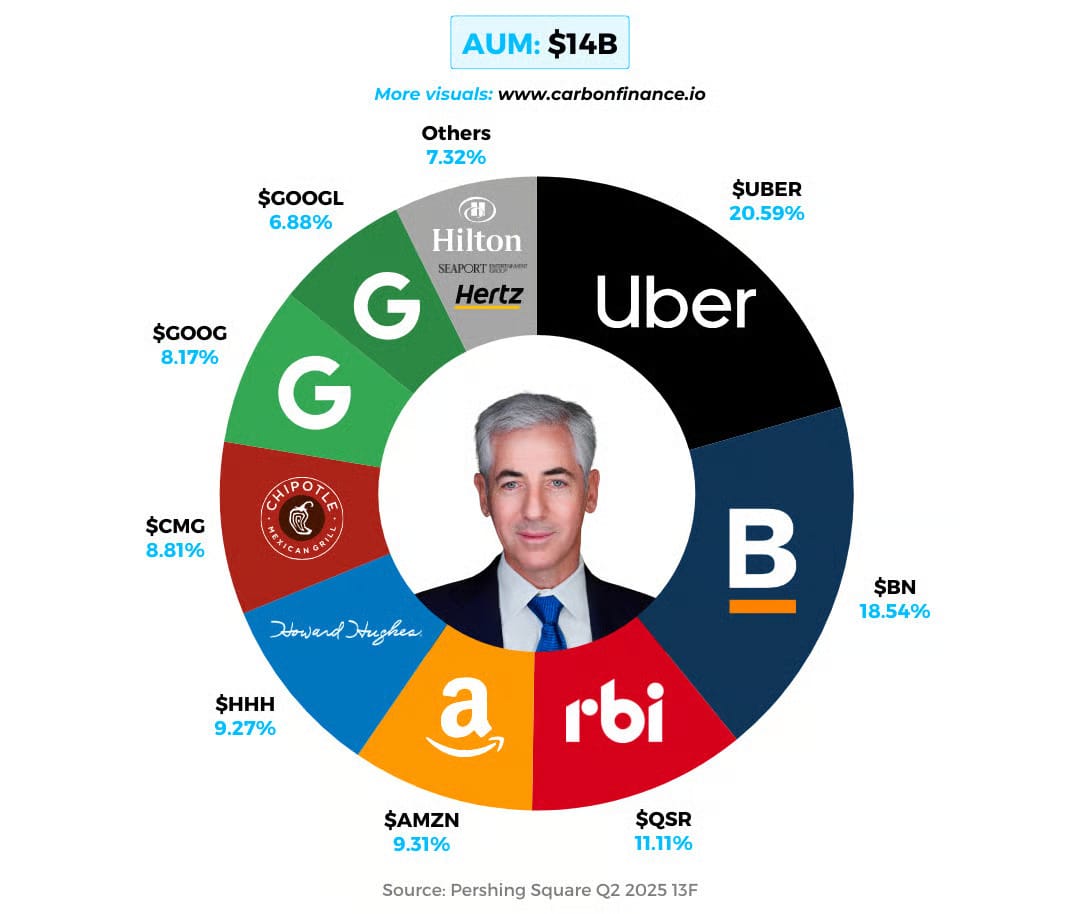

Bill Ackman: Hedge Fund Manager, CEO of Pershing Square Capital Management

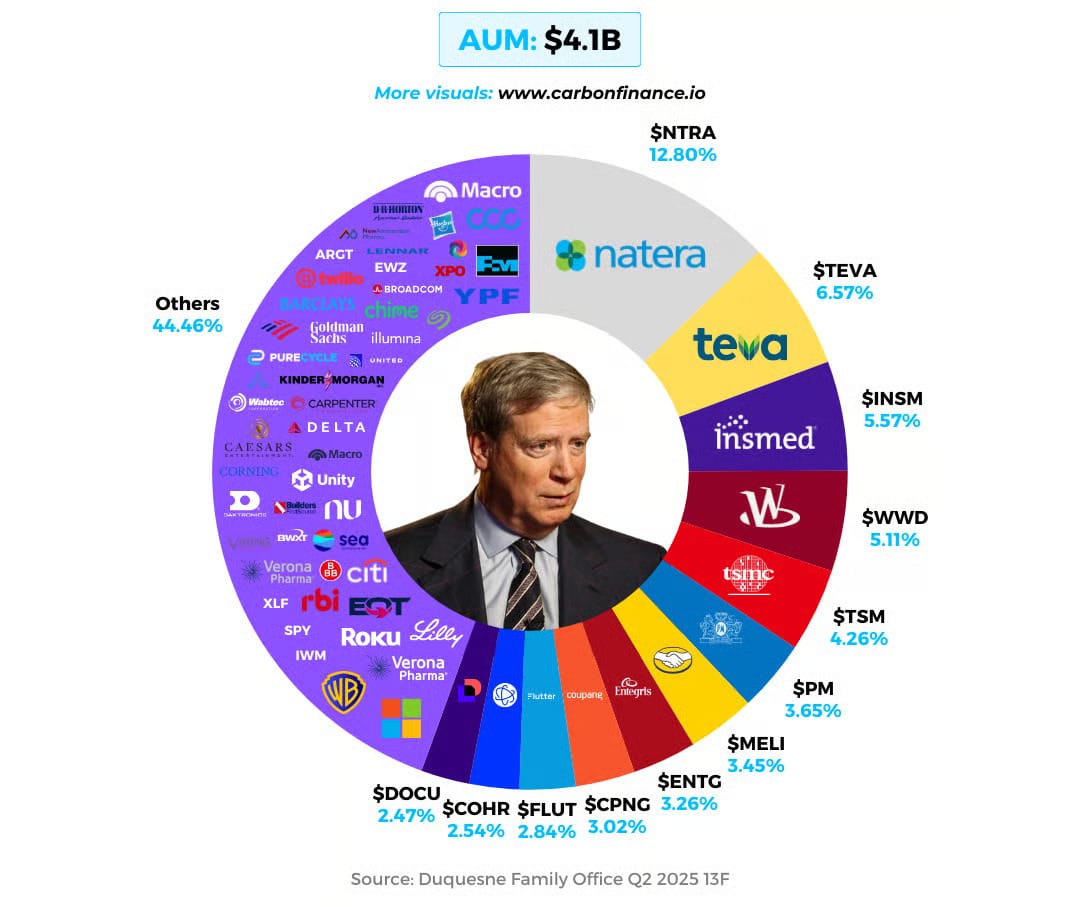

Stanley Druckermiller: Investor, Philanthropist, and Former Hedge Fund Manager

Should you build the exact same portfolio as these guys? Well, maybe not. Your portfolio should always be built based on your unique preferences and goals.

FINANCIAL SMARTS

Smart money moves to start young

Your teens and 20s are an incredible time because the money, career, and life decisions you make while you’re young can have a really positive impact on your life down the road. Here are a few smart money moves to start while you’re young:

Start using a budget

Whether you’re working your first job, off to college, starting your career, or wanting to save up for a house or another large purchase, your spending habits impact the rest of your financial picture. It’s a good idea to start keeping track of what you’re spending, saving, and investing every month. Send us a reply if you’d like a helpful tool for this.

Build an emergency fund

Aim to keep three to six months of living expenses in a savings account. It gives you a safety net, so little surprises don’t turn into big problems.

Tackle high-interest debt

Credit cards and personal loans add up fast and can be tough to recover from. The quicker you knock those out, the easier it is to start moving forward.

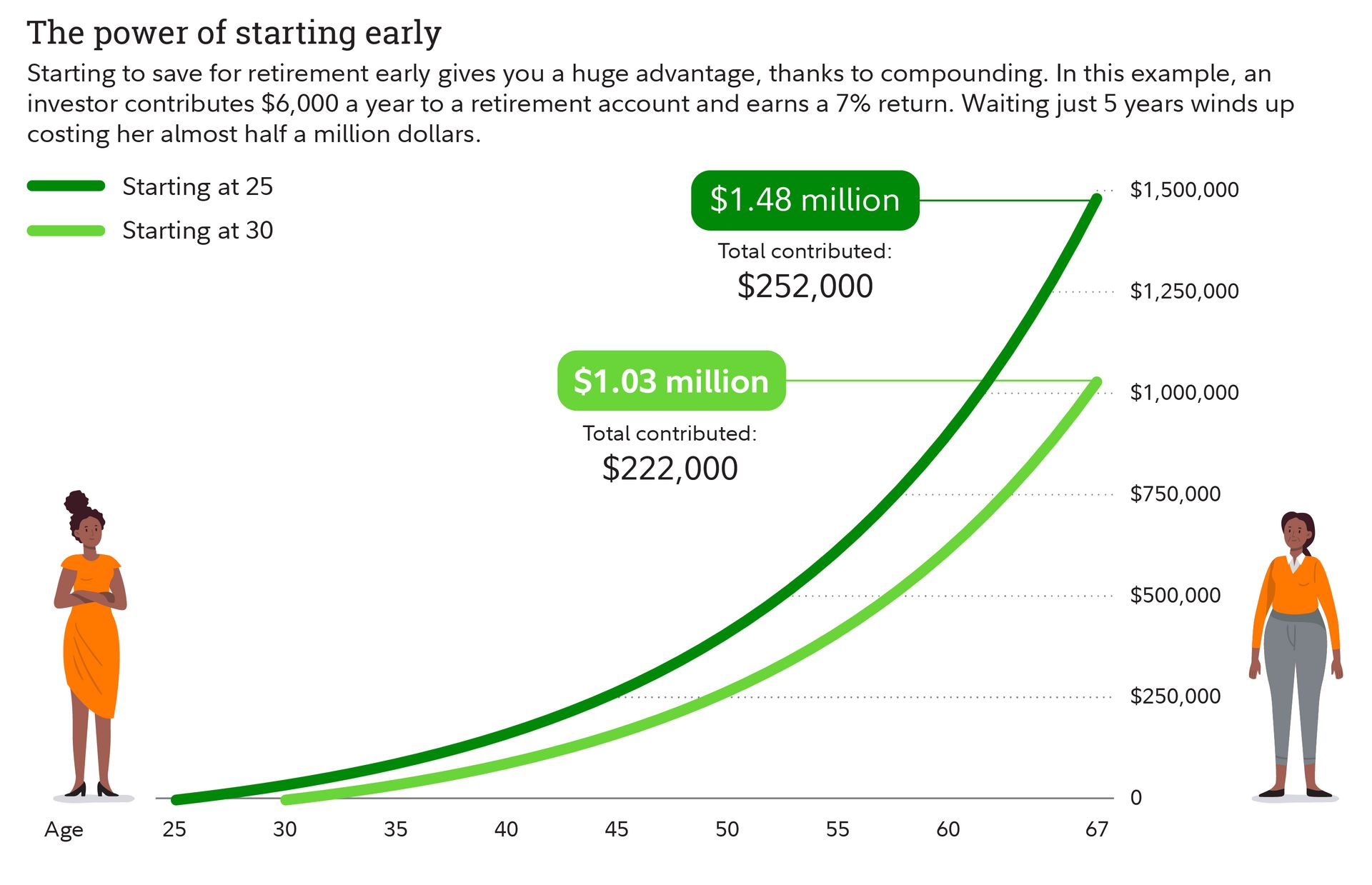

Start investing early

Compound interest is a powerful thing. Even small amounts in an IRA or a workplace retirement account can grow into something big over time. Make sure to take advantage of any workplace retirement plans or matching opportunities that are available through your work.

Use credit to your advantage

A good credit score makes life easier later on when you need to buy a car or a house. It’s a good idea to get a credit card, use it responsibly, and pay it off on time and in full every month. More on that later in this email.

Keep lifestyle inflation in check

As you start to make money and earn raises, put part of your additional income toward savings and investments instead of always spending more. And even though it’s hard, try not to get caught up in comparing your lifestyle to other people in their 20s. You can’t believe everything you see on social media… remember, everyone is running their own race.

Invest in yourself

We’re all for saving and investing, and the reality is this is also a great time to invest in yourself. That might look like taking courses, gaining new skills, getting a business coach, or building new relationships. These things can pay off BIG in the long run.

Your teens and 20s are an awesome time in your life. Don’t forget to have a bunch of fun. We don’t want you to stress too much about making the right financial decisions, so that’s why we’re here to help.

ASK THE ADVISORS

“Should I be using a credit card?”

A: Yes, with the right habits. Credit cards can be a smart tool for building credit history, which you’ll need down the road for things like renting an apartment, buying a car, or even getting a mortgage. They also come with pretty cool perks and rewards that can be nice to take advantage of.

What to watch out for:

Interest: If you carry a balance, interest charges can grow fast. Think of it like buying sneakers for $100 and paying $140 by the time you’re done.

Minimum payments: Paying only the minimum might feel easy, but it keeps you in debt longer and costs you more.

Lifestyle creep: It’s easy to spend more when you don’t feel the cash leaving your bank account. Treat your credit card like a debit card and only spend the money you know you will have.

Our advice:

Credit cards should be treated as a tool, with discipline and good habits. Pay your balance in full, on time, every month. Start with one card, keep limits manageable, and focus on building a positive credit history early.

Done right, credit cards can open doors and be really helpful. Done wrong, they can put you in a financial hole that can be a challenge to get out of.

If you don’t have one yet, it’s a great conversation to start having with your parents because credit will be important down the road.

Have a question you’d like us to answer in a future newsletter? Simply reply to this email to submit it to us.

CONTENT CORNER

Reading and Listening Recs

📚 Book Recommendation

Almanack of Naval Ravikant: A Guide to Wealth and Happiness

This book isn’t just about money; it’s about designing a life you actually want. Naval breaks down wealth, happiness, and decision-making in a way that clicks. As an advisor, I think it’s the kind of perspective every young person should start with. Find it here.

🎧 Podcast Recommendation

Michael Ovitz: Knowledge Is Power

The episode with Michael Ovitz on the Invest Like the Best with Patrick O’Shaughnessey podcast is a great one. Ovitz built one of the most powerful talent agencies from scratch, and his stories hit hard. For anyone in the beginning stages of their career, it’s a raw look at how power really works. Listen here.

📚 Book Recommendation

How to Invest by David Rubenstein

The book is filled with tons of wisdom and great interviews with some of the world’s most successful investors. My favorite chapters are the interviews with Seth Klarman, Jon Gray, Adebayo Ogunlesi, and Marc Andreessen. Find it here.

ICYMI

Third View In The News

Congratulations to Third View Co-Founders Jerry Sneed and Frank McKiernan for being named Forbes Best-In-State Top Next-Gen Wealth Advisors in 2025.

Congratulations to Third View Co-Founder Zoltan Pongracz for becoming an official member of the 2025 Forbes Finance Council.

This exclusive, invitation-only community of senior financial leaders is recognized for driving innovation, elevating standards, and shaping conversations that impact the global financial landscape. See the post here.

More Press

That’s all for this month. If you enjoyed the newsletter, the greatest compliment would be to forward it to someone you think would like it too.

- Frank, Jerry, and Zoltan

Forwarded this message?

Sign up here to receive future Third View Next Gen Newsletter editions in your inbox.

Any media logos and/or trademarks are the property of their respective owners and no endorsement by those owners of the advisor or firm is stated or implied.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Information obtained from third-party sources is believed to be reliable though its accuracy is not guaranteed, and Third View Private Wealth makes no representation or warranty as to the accuracy or completeness of the information, which should not be used as the basis of any investment decision. Information contained on third party websites that Third View Private Wealth may link to is not reviewed in their entirety for accuracy and Third View Private Wealth assumes no liability for the information contained on these websites. Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of writing and are subject to change without notice. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Third View Private Wealth. For more information about Third View Private Wealth, including our Form ADV brochures, please visit https://adviserinfo.sec.gov or contact us at (203) 408-0098.