Welcome to the Third View Perspectives Newsletter—your monthly source for financial intelligence and trusted advice to help you make more informed decisions on behalf of you, your family, and your legacy.

Forwarded this newsletter? Subscribe here to receive future editions.

EDITORIAL

10 Lessons From 10 Years in Private Wealth Management

Published in Barron’s | Written by Frank McKiernan, Co-Founder & Managing Partner

Over the last 10 years, I’ve had the privilege of walking alongside individuals and families as they navigate the unique complexities that accompany significant wealth.

I’ve learned 10 key lessons about life and money that keep resurfacing, regardless of market cycles or net worth. These ideas have shaped my thinking, influenced my work, and hopefully offer valuable insights for anyone navigating their own wealth journey.

1. Price is only relevant in the absence of value.

The most discerning clients I work with never ask, “What does this cost?” Their first question is, “What do I get for this?” Whether it’s an investment opportunity, or a new advisory relationship, they’re focused on the value being delivered.

2. Time is your most valuable asset.

Wealth buys many things, but not more time. Eventually, every serious wealth conversation leads back to this idea: How do you want to spend your time?

It’s a question I ask not just in financial planning sessions, but when clients are contemplating a major business decision, or thinking about estate planning. If a decision gives you more time back (or peace of mind), it’s almost always worth it.

3. You can’t control markets but you can control your response.

No one, regardless of their intelligence, education, or wealth can reliably predict short-term market movements. Realizing this becomes especially important during market dislocations.

I’ve seen clients paralyzed in fear during sharp drawdowns, and others overconfident during market rallies. The common thread among the most resilient investors? They have a plan and a set of principles that help them stay grounded when the world isn’t.

4. Life will bring tough times.

Have the right people in the room. The moments that define a family’s financial life are rarely easy: The death of a patriarch or matriarch, the sale of a decades-old business, or a contentious estate issue.

During these moments, having the right voices at the table is invaluable. Not just technically sound advisors but ones who can slow the conversation down, ask the hard questions, and help everyone see around corners. I’ve seen fortunes preserved and destroyed based on who was in the room when the big decisions got made.

5. Your reputation is everything.

In a 2002 Berkshire Hathaway annual meeting, Warren Buffett famously said, “It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.”

Reputation is a form of capital. It opens doors, builds trust, and creates opportunities. Reputational damage doesn’t just impact your business or brand. It can erode trust, compromise your legacy, and leave a trail that money alone can’t fix.

6. Find something that fills your cup outside of work.

One of the most underappreciated emotional challenges in wealth management is identity loss. For founders who sell a business, there’s often an unexpected void. Their calendars are clear. The adrenaline drops. And the big question looms: Who am I without this?

Wealth gives you the freedom to explore. But fulfillment doesn’t come from a term sheet or a balance sheet. It comes from purpose.

7. AI can do a lot, but it can’t do this.

I’m a big believer in technology. AI will transform many parts of finance. But it won’t replace the deeply human moments that shape how wealth is used, transferred, or protected.

There is no algorithm for grief. No AI can replace the emotional support a family needs during a health crisis or a generational wealth transfer.

8. Timing the market is a fool’s errand.

I’ve had clients ask whether they should wait until after the election, or until interest rates peak, or until valuations compress before investing. Here’s the hard truth: If you’re waiting for the perfect moment, you’ll miss it. Long-term wealth creation has far more to do with discipline than timing.

9. Just because you can afford it, doesn’t mean you should buy it.

Every financial decision has an acquisition cost and an opportunity cost. The higher the acquisition cost, the higher the opportunity cost. Spend wisely.

10. Humans overestimate risk and underestimate opportunity.

Fear is a powerful emotion. When we lean too heavily into risk avoidance, we can miss the upside. Whether it’s starting a new business venture, or taking on a meaningful philanthropic opportunity, fear can quietly erode the very benefits wealth is meant to provide.

The most successful clients I work with are optimistic. They understand risk, but they don’t let it paralyze them. They understand that the best opportunities rarely come gift-wrapped.

FINANCIAL INTELLIGENCE

4 Important Reminders for Q4

With Q4 underway and the year drawing to a close, now is an excellent time to review key financial and tax planning strategies. Here are some important reminders to help you make the most of the upcoming months.

Roth Conversions

As we approach year-end, consider whether a Roth conversion makes sense for you this year. For some, converting a portion of an IRA to a Roth account can help manage future income tax exposure and create flexibility in retirement income planning.

Charitable Giving Strategies

If charitable giving is part of your plan, consider options like donating appreciated securities and contributing to a donor-advised fund. These strategies provide a meaningful impact while offering potential tax advantages in high-income years.

Family Gifting

Now is the ideal time to finalize any 2025 gifting plans. You can give up to $19,000 per recipient this year ($38,000 if you are married) without using your lifetime exemption. For larger gifts or trust strategies, early action ensures valuations and documentation are completed before year-end.

Medicare Enrollment

Medicare open enrollment runs from October 15 through December 7. This is your window to review plan options, confirm coverage still fits your needs, and make any necessary updates for the year ahead.

ASK THE ADVISORS

Are we in a bubble?

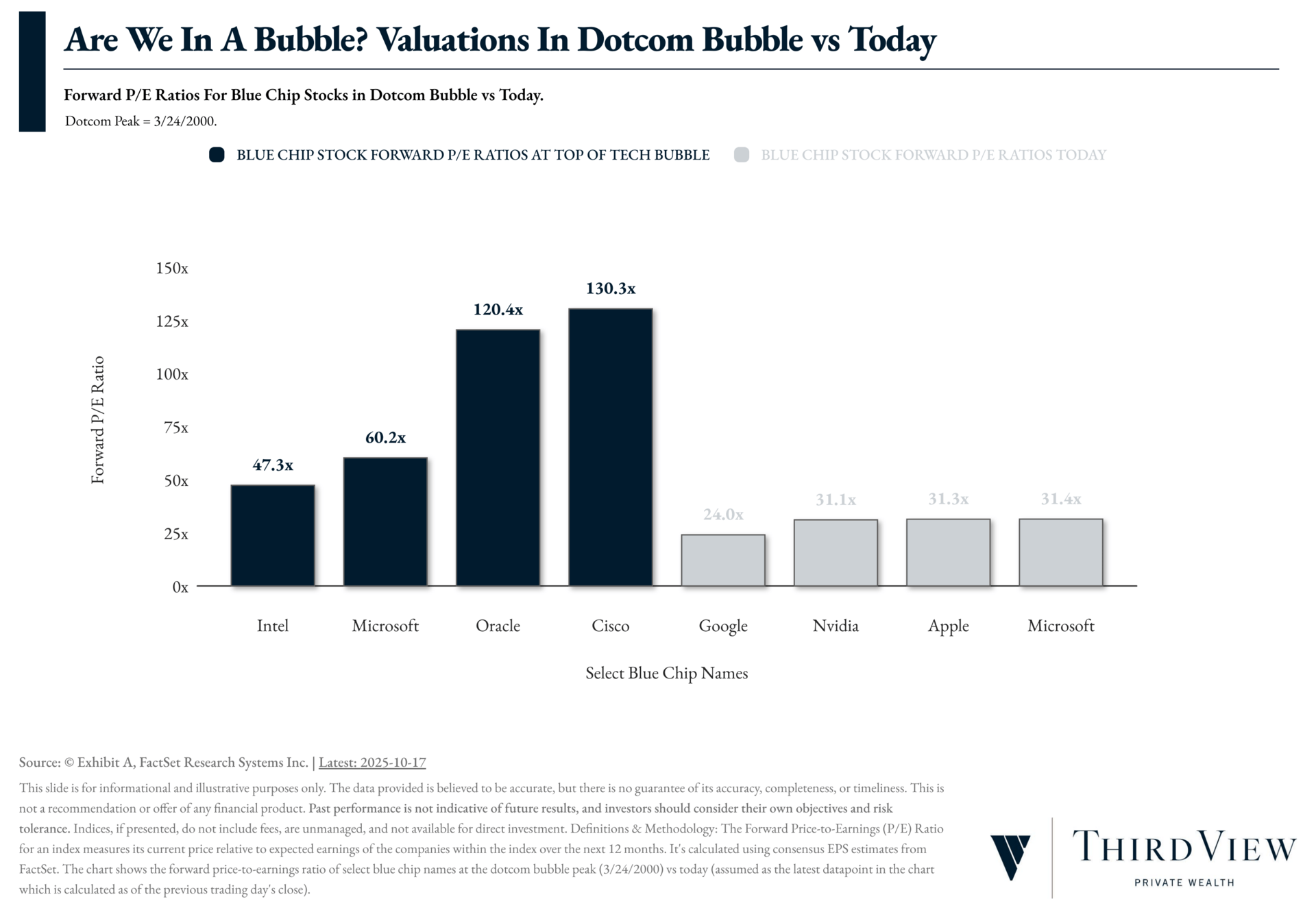

A: We don’t believe we are in a bubble. While certain pockets of the market may exhibit frothy behavior at times, the broader market does not appear to be exhibiting signs of a bubble.

To put things in perspective, it helps to look at how today’s valuations compare to those during the Dotcom era. Take a look at this graphic comparing blue chip valuations then and now:

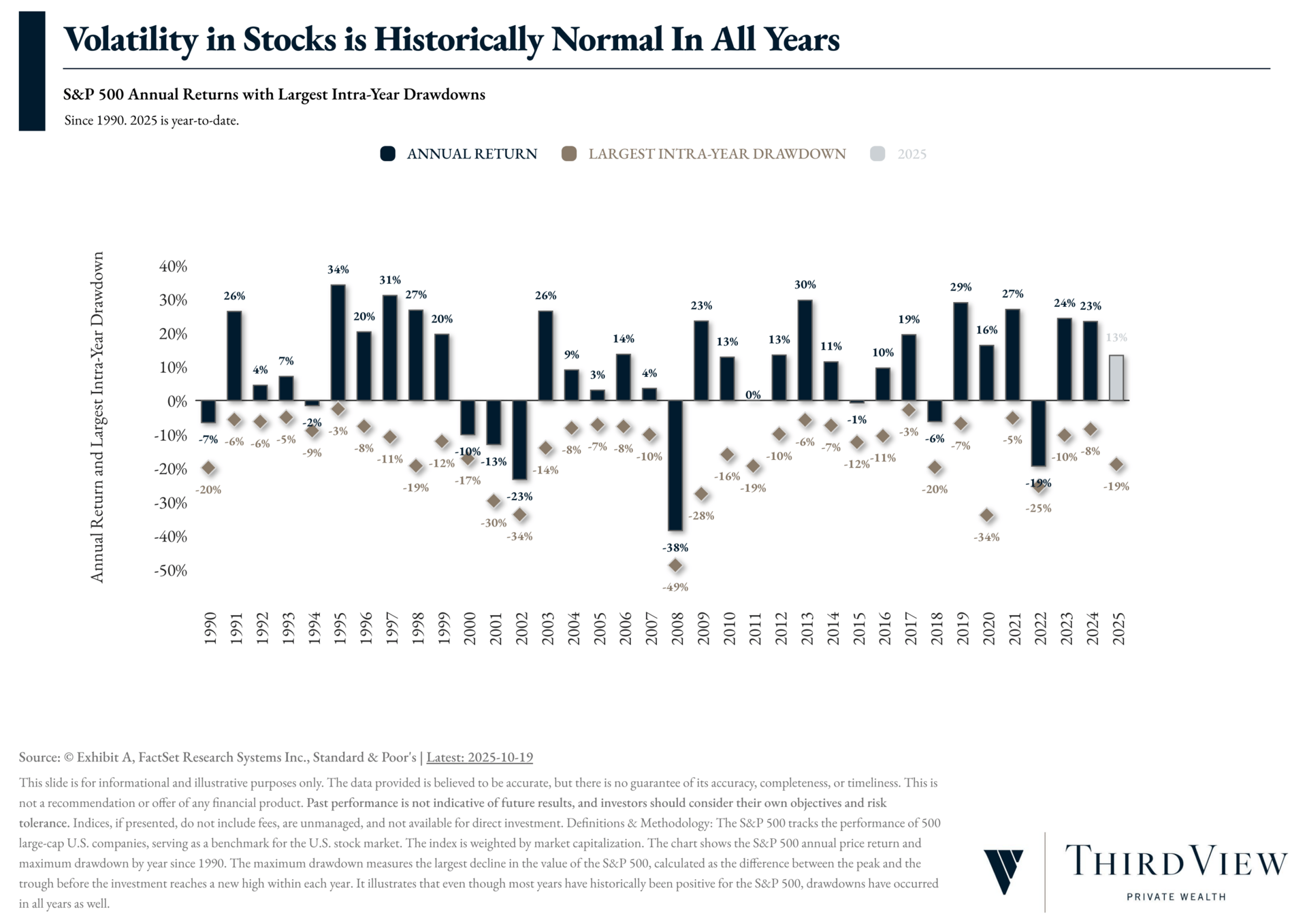

The more likely outcome is periods of increased volatility surrounding certain sectors of the economy, which will lead to a repricing of excesses, rather than an abrupt collapse. And as a reminder, volatility in stocks is historically normal every year.

The main takeaway here is that investors should use the playbook of Howard Marks: stay vigilant, differentiate between sectors, and prepare defensively, but not panic prematurely. Corrections or volatility are more probable than a “big crash.”

Have a question you’d like us to answer in a future newsletter? Simply reply to this email to submit it to us.

CONTENT CORNER

What We’re Paying Attention To

🎧 This podcast with Jensen Huang, NVIDIA’s founder and CEO, was great. If you’re interested in where technology, investing, and innovation intersect, this is a must-listen. Listen here.

🎧 Jamie Dimon, CEO of JPMorgan Chase, is always a wealth of knowledge and experience. Really interesting interview on his career and learnings along the way on the Acquired Podcast. Listen here.

📖 Who is Michael Ovitz is a great read. It details the strategies he employed to reinvent the role of the agent and shape the careers of people like Steven Spielberg, Martin Scorsese, Meryl Streep, Robin Williams, and more. Find it here.

ICYMI

Our Latest News, Press, and More

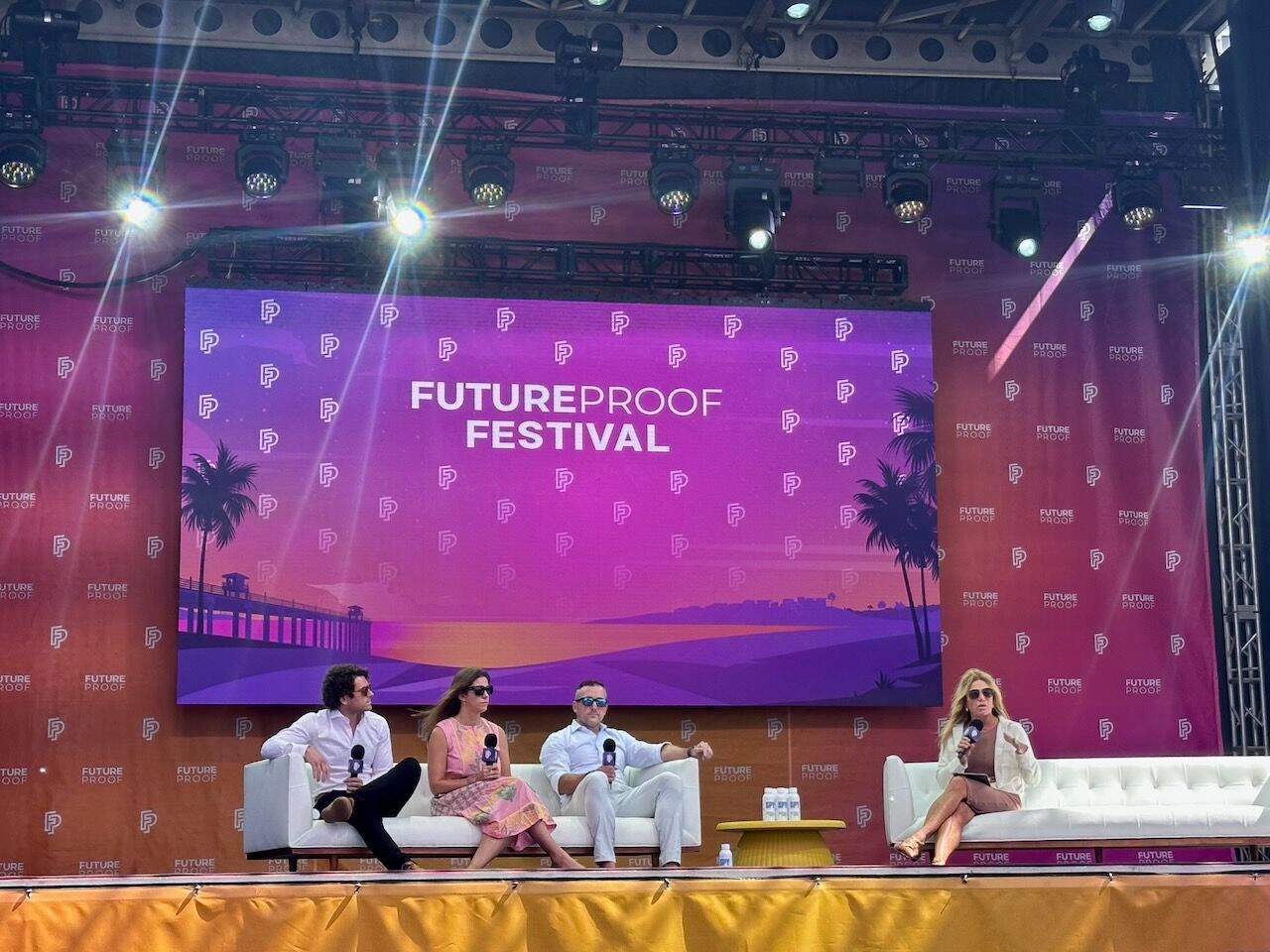

Co-Founders Jerry Sneed and Frank McKiernan recently hit the road and traveled to the West Coast to meet with clients and take the stage at Future Proof—The World’s Largest Wealth Festival.

Both Jerry and Frank were featured speakers, sharing their perspectives with an audience of thousands of the top financial advisors and wealth management executives from around the world.

Jerry Sneed on the stage.

Frank McKiernan on a featured panel.

More Press

THIRD VIEW UPDATES

Our Latest Viewpoint Update

In case you missed it, we recently sent out our recent Viewpoint report with Q3 insights, a market brief on where things are right now, and what’s ahead. Download and read the briefing using the link below.

That’s all for this month. If you enjoyed the newsletter, the greatest compliment would be to forward it to someone you think would find it valuable. We’ll be back with more next month.

- Frank, Jerry, and Zoltan

Forwarded this message?

Sign up here to receive future newsletter editions in your inbox.

Any media logos and/or trademarks are the property of their respective owners and no endorsement by those owners of the advisor or firm is stated or implied.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Information obtained from third-party sources is believed to be reliable though its accuracy is not guaranteed, and Third View Private Wealth makes no representation or warranty as to the accuracy or completeness of the information, which should not be used as the basis of any investment decision. Information contained on third party websites that Third View Private Wealth may link to is not reviewed in their entirety for accuracy and Third View Private Wealth assumes no liability for the information contained on these websites. Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of writing and are subject to change without notice. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Third View Private Wealth. For more information about Third View Private Wealth, including our Form ADV brochures, please visit https://adviserinfo.sec.gov or contact us at (203) 408-0098.